"If only EssExTee could be so grossly incandescent" (essextee)

"If only EssExTee could be so grossly incandescent" (essextee)

11/23/2019 at 17:36 • Filed to: None

1

1

19

19

"If only EssExTee could be so grossly incandescent" (essextee)

"If only EssExTee could be so grossly incandescent" (essextee)

11/23/2019 at 17:36 • Filed to: None |  1 1

|  19 19 |

BoxerFanatic, troublesome iconoclast.

> If only EssExTee could be so grossly incandescent

BoxerFanatic, troublesome iconoclast.

> If only EssExTee could be so grossly incandescent

11/23/2019 at 17:45 |

|

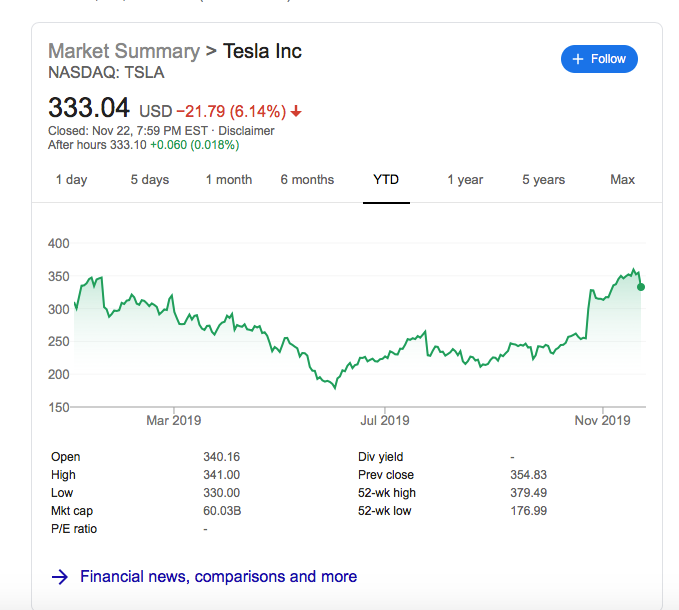

Love how the graph scale automatically exaggerates the drop by only charting the top 10% range... ~ 30 dollars/share on top of 330 $/share.

Not saying that I like Musk, Tesla, the cult of personality, or the ridiculous truck, or whether the company is properly valu ed or not.

I’m just saying first glance makes that chart look like a much larger cliff than it actually fell off of... more like a single step down.

Cé hé sin

> If only EssExTee could be so grossly incandescent

Cé hé sin

> If only EssExTee could be so grossly incandescent

11/23/2019 at 17:50 |

|

But the graph doesn't begin at zero. Never trust a graph like that.

ranwhenparked

> BoxerFanatic, troublesome iconoclast.

ranwhenparked

> BoxerFanatic, troublesome iconoclast.

11/23/2019 at 17:52 |

|

You can set the time period for anything you want, here’s year to date.

DipodomysDeserti

> If only EssExTee could be so grossly incandescent

DipodomysDeserti

> If only EssExTee could be so grossly incandescent

11/23/2019 at 17:56 |

|

I don’t do stock market shit, but as someone who teaches children how to read graphs, a drop of less than 10% that looks that extreme should tell you someone is trying to fuck with you.

Dr. Zoidberg - RIP Oppo

> If only EssExTee could be so grossly incandescent

Dr. Zoidberg - RIP Oppo

> If only EssExTee could be so grossly incandescent

11/23/2019 at 18:06 |

|

Filed to: misleading graphs

SilentButNotReallyDeadly...killed by G/O Media

> If only EssExTee could be so grossly incandescent

SilentButNotReallyDeadly...killed by G/O Media

> If only EssExTee could be so grossly incandescent

11/23/2019 at 18:31 |

|

A graphic display of how to do graphs wrong...

Chuckles

> DipodomysDeserti

Chuckles

> DipodomysDeserti

11/23/2019 at 18:33 |

|

I'm not sure that it's intentionality misleading, but rather it's just how Google auto scales things for the time period.

fintail

> If only EssExTee could be so grossly incandescent

fintail

> If only EssExTee could be so grossly incandescent

11/23/2019 at 18:47 |

|

Tesla could shoot someone in broad daylight on 5th Avenue and get away with it.

wafflesnfalafel

> If only EssExTee could be so grossly incandescent

wafflesnfalafel

> If only EssExTee could be so grossly incandescent

11/23/2019 at 18:53 |

|

something, something, “lies, damn lies & statistics”

honestly, I think it’s probably more a fairly typical case of buy on the speculation sell on the news.

But that doesn’t mean the truck isn’t weird and goofy. I want to know where they mounted the flux capacitor.

If only EssExTee could be so grossly incandescent

> Cé hé sin

If only EssExTee could be so grossly incandescent

> Cé hé sin

11/23/2019 at 18:56 |

|

I wasn’t presenting the graph as if the lowest value on the y axis was 0. $20/s hare is still a significant drop.

Under_Score

> If only EssExTee could be so grossly incandescent

Under_Score

> If only EssExTee could be so grossly incandescent

11/23/2019 at 19:43 |

|

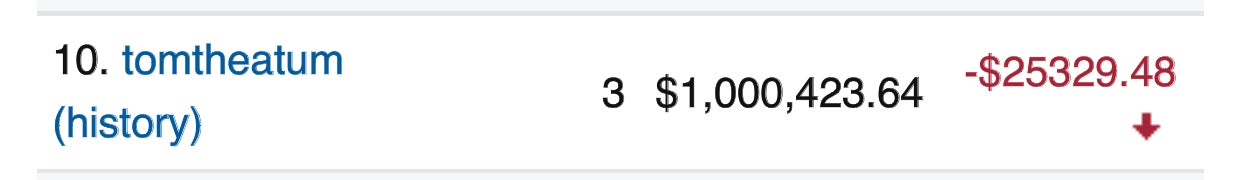

I was trying not to think about that today. I had a dream I was actually at $1,007,000, but nope. That number is after selling more than half my shares and buying shares for new companies, by the way.

(This is a simulator, but it’s a grade based on how well you do).

BoxerFanatic, troublesome iconoclast.

> ranwhenparked

BoxerFanatic, troublesome iconoclast.

> ranwhenparked

11/23/2019 at 21:09 |

|

yes, you can change the time period. The chart max and minimum values set the x-axis dollar scale, even there.

That makes it look like the end of June was a crash.. and while it was low, a drop from ~ 350 to ~ 18 0 is a ~50% drop in value by dollar figures , not a 90% drop as the chart would appear graphically.

bhtooefr

> BoxerFanatic, troublesome iconoclast.

bhtooefr

> BoxerFanatic, troublesome iconoclast.

11/24/2019 at 07:32 |

|

That’s how basically everyone does stock market graphs AFAIK , and yes, it’s wrong.

bhtooefr

> wafflesnfalafel

bhtooefr

> wafflesnfalafel

11/24/2019 at 07:36 |

|

Yep, almost every Tesla announcement (quarterly sales, quarterly earnings, new products, etc., etc.) has a drop immediately afterwards, with a rise going into it.

The exception is if something is unexpected - even bulls were expecting a loss going into Q3 earnings, as an example, and that combined with the Cybertruck speculation drove the stock from the mid $250s to flirting with $360.

Pulling back to the mid $330s after an expected announcement, when the announced vehicle was far weirder than expected (although, Musk did warn everyone it’d be weird - in retrospect, exactly what was teased was revealed) ? Nah, not too bad.

BoxerFanatic, troublesome iconoclast.

> bhtooefr

BoxerFanatic, troublesome iconoclast.

> bhtooefr

11/24/2019 at 18:57 |

|

Wrong depends on your frame of reference.

Accurate analytics for rational investment strategy , yes, it is skewed and exaggerated graphically making it more work to actually analyze performance metrics.

For trade frequency and volume, and triggering trades based on emotion (which seems like 90% of what drives the stock market under a thin veneer of analysis) , which in turn trigger commissions, dramatic swings catch investors and trader’s eyes.

davesaddiction @ opposite-lock.com

> Under_Score

davesaddiction @ opposite-lock.com

> Under_Score

11/25/2019 at 09:03 |

|

I assume you started with $1,000,000?

Under_Score

> davesaddiction @ opposite-lock.com

Under_Score

> davesaddiction @ opposite-lock.com

11/25/2019 at 15:49 |

|

Yes. I jumped to nearly $1,014,000 today, though! Good market conditions today, and Tesla somewhat recovered from their oopsie.

davesaddiction @ opposite-lock.com

> Under_Score

davesaddiction @ opposite-lock.com

> Under_Score

11/25/2019 at 16:01 |

|

Nice recovery. A 1.4% return, so far!

I guess this isn’t the time to mention that I get 2% in my saving account.

=)

Under_Score

> davesaddiction @ opposite-lock.com

Under_Score

> davesaddiction @ opposite-lock.com

11/25/2019 at 18:19 |

|

I ended up closer to $1,015,000 by close. Good news for me!